Are you eager to cruise in the vehicle of your fantasies? We recognize that a dream car is more than just transportation; it's an expression of your taste. That's why we offer a range of auto loan options to aid you acquire the perfect machine for your requirements.

- Favorable interest rates

- Flexible payment plans

- Quick approval process

Don't allow your dream car remain a aspiration. Contact our auto loan advisors today and take the first step toward driving your dream.

Secure an Reasonable Auto Loan Today

Are you dreaming of driving a new auto? Don't let financing be a hurdle. We offer competitive interest rates and flexible payment to make your car ownership a reality. With our simple application process, you can qualify for an auto loan today!

- Check out our wide selection of loan programs

- Talk to one of our knowledgeable loan officers

- Initiate your application online or in person today!

Purchase Auto Loans: Drive Away with Confidence

Securing an auto loan can feel daunting, but it doesn't have to be. With a little research, you can navigate the process smoothly and find the perfect financing choice for your requirements. Credit unions offer a range of loan programs, so you can select one that satisfies your budget and aspirations.

Before you apply for an auto loan, collect the necessary documents, such as proof of revenue, your financial history, and identification information. Comprehending your credit score is also crucial, as it can influence the interest rate you'll be offered.

- Compare rates from various lenders to confirm you're getting the most competitive terms.

- Review the loan agreement thoroughly before signing. Become aware yourself with the interest rate, repayment term, and any charges involved.

- Protect a good credit history to boost your chances of approval.

Searching for Perfect Auto Loan to Fit Your Budget

Buying a car is an exciting endeavor, but it's important to strategize about your financing options. A competitive auto loan can make the process seamless, allowing you to drive away in your dream vehicle without putting yourself in debt.

When it comes to securing an auto loan, there are plenty of factors to keep in mind. First and foremost, you'll want to determine your budget. How much can you comfortably manage each month? Once you have a solid understanding of your financial limits, you can start comparing rates.

Comparing different lenders and their interest rates is crucial. Don't just settle for the first offer you receive. Take your time to analyze multiple loan terms and conditions to find the best option for your needs.

Remember, a good auto loan should suit your budget and financial goals. With a little effort, you can secure an auto loan that will assist you in achieving your automotive dreams.

Optimize Your Auto Purchase with a Pre-Approved Loan

Buying a new vehicle should be an exciting adventure, not a stressful ordeal. One way to ensure a smooth process is by obtaining a pre-approved loan get more info before you even step a dealership. This puts you in a commanding negotiating position and enables to focus on finding the perfect car for your needs without the strain of financing.

With a pre-approved loan, you already know how much you can spend, giving you a clear budget. You'll also have a better understanding of your monthly installments, making it easier to formulate a realistic budget for your car costs. Dealerships are more likely to work with you when they know you're pre-approved, as it shows that you're a serious and dedicated buyer.

In short, a pre-approved loan can significantly simplify the car buying process. It empowers you with awareness, saves you time and anxiety, and ultimately puts you in control of your automotive investment.

Explore Competitive Auto Loan Rates and Terms

Securing an auto loan is a crucial step when purchasing a new or used vehicle. With numerous lenders offering a wide array of loan options, it's essential to thoroughly compare rates and terms to obtain the most favorable deal.

Initiate your search by comparing quotes from multiple lenders, comprising banks, credit unions, and online lending platforms. Pay close attention to the annual percentage rate (APR), loan term, and any associated fees.

Evaluate your monetary situation when determining a loan that meets your needs. A lower APR will result in lower overall interest payments, while a shorter loan term may lead to higher monthly payments but fewer interest paid over time.

Ultimately, securing the best auto loan involves exploring your options and determining the terms that favor your financial health.

Alana "Honey Boo Boo" Thompson Then & Now!

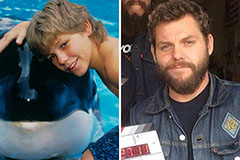

Alana "Honey Boo Boo" Thompson Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Destiny’s Child Then & Now!

Destiny’s Child Then & Now! Hailie Jade Scott Mathers Then & Now!

Hailie Jade Scott Mathers Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!